A real-time snapshot of total net worth—across banks, brokers, and custodians. Instantly understand the full financial picture, all in one place.

We built Finberry to give both advisors and investors the tools they’ve been missing: smarter workflows, clearer insights, and seamless collaboration. This is wealth management reimagined and retooled.

Finberry Ltd is a licensed portfolio manager by the Israel Securities Authority, license #846.

Wealth management is changing. As client expectations grow and mid-wealth demand rises, many advisors are held back by outdated tools and time-consuming processes.

Finberry offers a modern platform that helps advisors work more efficiently and reach more clients—while giving investors a clear, connected view of their financial lives. By unifying data, strategy, and collaboration, Finberry makes it easier to deliver better outcomes, whether the journey is advisor-led, investor-driven, or both.

Enabling advisors to grow and investors to stay in control – on one seamless platform.

Smart tools to help advisors grow, stay independent, and serve more clients—without the overhead.

A seamless platform that improves how investors engage, invest, and build trust in their advisors.

No hidden motives. Just clear, unbiased tools built to support better choices on both sides.

Automation and insights that save time, reduce admin, and improve real outcomes.

WELCOME TO FINBERRY

Finberry is a next-generation platform powering how modern wealth is managed. Built for financial professionals and designed with investors in mind, it delivers the infrastructure, tools, and connections that enable better decisions—without replacing the human element.

We don’t offer financial advice. We make it scalable.

Through AI-powered insights, seamless integrations, and advisor access, Finberry simplifies complexity and opens new possibilities—for those guiding wealth and those growing it.

Getting started is free.

Investors can explore the platform at no cost, with the option to upgrade as their needs evolve. This flexibility makes Finberry accessible to a wider audience, without compromising on the quality of experience.

This isn’t traditional wealth management.

This is smarter, scalable, human.

This is Finberry.

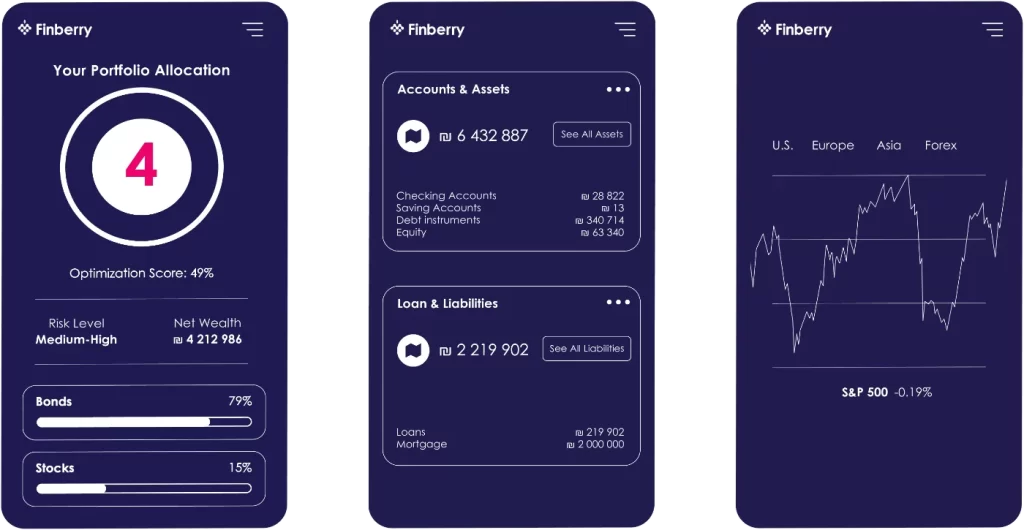

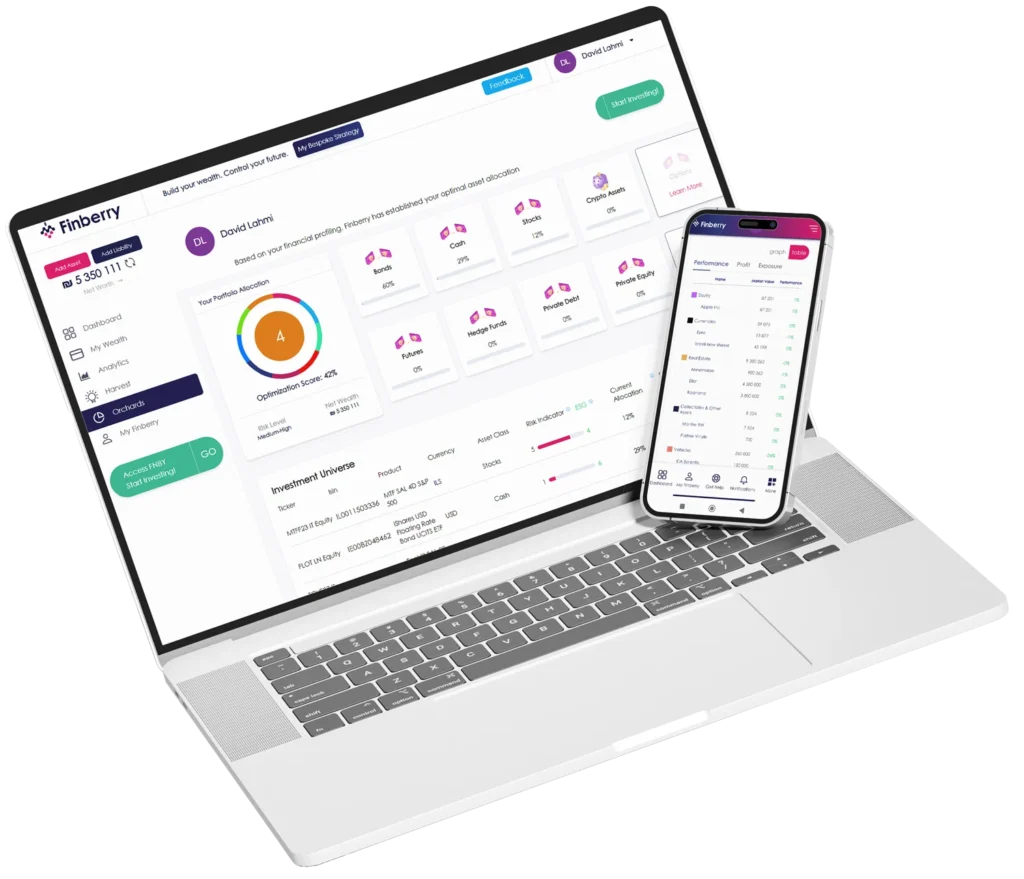

One View. Smarter Decisions.

Finberry brings together financial data from banks, investment accounts, loans, and more—across Europe and Israel—into a single, secure platform. But it’s not just about seeing everything in one place.

With AI-powered insights and dynamic analytics, Finberry helps advisors deliver more value while giving investors the clarity to make informed choices. From real-time tracking to smart suggestions, the platform supports better financial decisions—whether guided by an advisor or taken independently.

Finberry’s analytics suite is designed to turn financial complexity into clarity—for both investors making decisions and advisors guiding them. With three dynamic layers, the platform helps uncover what matters most, from big-picture strategy to performance-level precision.

A real-time snapshot of total net worth—across banks, brokers, and custodians. Instantly understand the full financial picture, all in one place.

Zoom into each account, portfolio, and position. Spot gaps, assess risk exposure, and stay aligned with long-term strategy—at a glance.

Track returns, measure progress, and analyze trends. Powerful performance analytics bring meaning to results and support smarter next steps.

Finberry turns data into direction. With advanced analytics layered into every part of the platform, both investors and advisors can spot opportunities, monitor risk, and take action with clarity.

From rebalancing portfolios to managing liabilities, Finberry supports real-time decisions that align with long-term goals—turning insight into progress.

Through the Finberry Community, investors can discover experienced advisors who align with their goals, values, and financial mindset—making the process of finding guidance simple, transparent, and meaningful.

Advisors within the community bring deep knowledge across investing, planning, and wealth-building. Whether it’s a one-time check-in or a long-term strategy, support is just a connection away.

Finberry enables lasting connections—not quick transactions. As financial lives evolve, so do the relationships behind them—built on trust, flexibility, and shared progress.

Portfolio Manager

Zurich, CH

Financial Advisor

New York, US

Family Office

Lundon, UK

Financial Advisor

Berlin, GR

Portfolio strategist

Tel Aviv, IL

Portfolio Manager

Prague, cz

Finberry provides access to over 40,000 financial instruments across global markets—including equities, bonds, ETFs, mutual funds, structured products, private debt, and private equity. A single platform supporting broad diversification and deeper portfolio construction.

Designed to accommodate both discretionary management and self-directed strategies. Advisors can construct and execute tailored portfolios for clients, while independent investors benefit from professional-grade tools and autonomy where needed.

Real-time reporting, position-level visibility, and secure monitoring tools ensure full transparency—whether portfolios are advisor-managed or investor-led. Every action is trackable, reinforcing trust and accountability across the investment journey.

Finberry operates with the highest standards of data protection, regulatory compliance, and platform security. As a licensed portfolio management company regulated by the Israeli Securities Authority, all activity is subject to strict oversight and supervision.

The platform is fully compliant with GDPR and Israel’s nLDP data privacy regulations [link to data privacy]. All data is encrypted using AES-256-CBC—an international standard for protecting information in transit and at rest. Personal and financial data is never sold or shared with third parties.

Our legal and regulatory framework is supported by ROSCH Law, ensuring Finberry remains ahead of evolving compliance standards to safeguard every user and advisor on the platform.

Users can connect various financial accounts, including bank accounts, investment portfolios, and other assets, to gain a holistic view of their financial landscape.

Absolutely. Finberry employs AES-256 encryption to protect data in transit and at rest. The platform complies with GDPR and local data protection regulations, ensuring user information remains confidential and secure.

Finberry provides advisors with a suite of tools to manage client relationships, deliver personalized investment strategies, and streamline compliance processes. The platform enhances advisor efficiency and client engagement.

Yes. Investors can utilize Finberry’s tools to monitor their financial portfolios, analyze investment performance, and make informed decisions. The platform is designed to cater to both self-directed investors and those seeking professional guidance.

Finberry provides access to a wide range of investment instruments through its Trading Portal, including listed securities and private market opportunities. Investment execution can be done directly or through licensed professionals.

Finberry is free to start. Individual investors can connect up to two bank or investment accounts and access core features like portfolio tracking and basic financial insights at no cost. Upgrading unlocks advanced tools, including unlimited account aggregation, performance analytics, risk profiling, and advisor collaboration.

For advisors, pricing is tailored based on assets under management and feature usage, with scalable plans designed to support growth.

There are no minimum investment amounts required to open or maintain an account with Finberry.

Our goal is to provide accessible wealth management services regardless of a client’s current portfolio size. The only criteria for becoming a Finberry client is a commitment to long-term investment goals. We aim to serve investors at all stages of their financial journey, from first-time savers to seasoned portfolio holders.

Visit Finberry’s registration page to create an account. Once registered, you can begin linking your financial accounts and exploring the platform’s features.

Finberry’s platform is fully digital, combining cutting-edge AI and expert-driven insights to offer a comprehensive solution for investment services.

Share your goals and let’s connect you with ideas, people, and opportunities.